U.S. sanctions against Russian oligarchs and their associated companies demonstrate the value of Source of Wealth due diligence assessments that go beyond simply identifying the assets owned.

- The onus is on organizations to fully understand the ultimate beneficial ownership of clients or third parties, otherwise they may be exposed to sanctions violations.

- Fully unwrapping corporate structures helps organizations expose compliance risks buried within the ownership structure of a company.

- A proper source of wealth assessment goes beyond simply identifying the assets owned.

Amid rising tensions between Russia and the West, the U.S. government has issued fresh sanctions targeting Russian oligarchs, the companies they own, government officials and state-run entities.

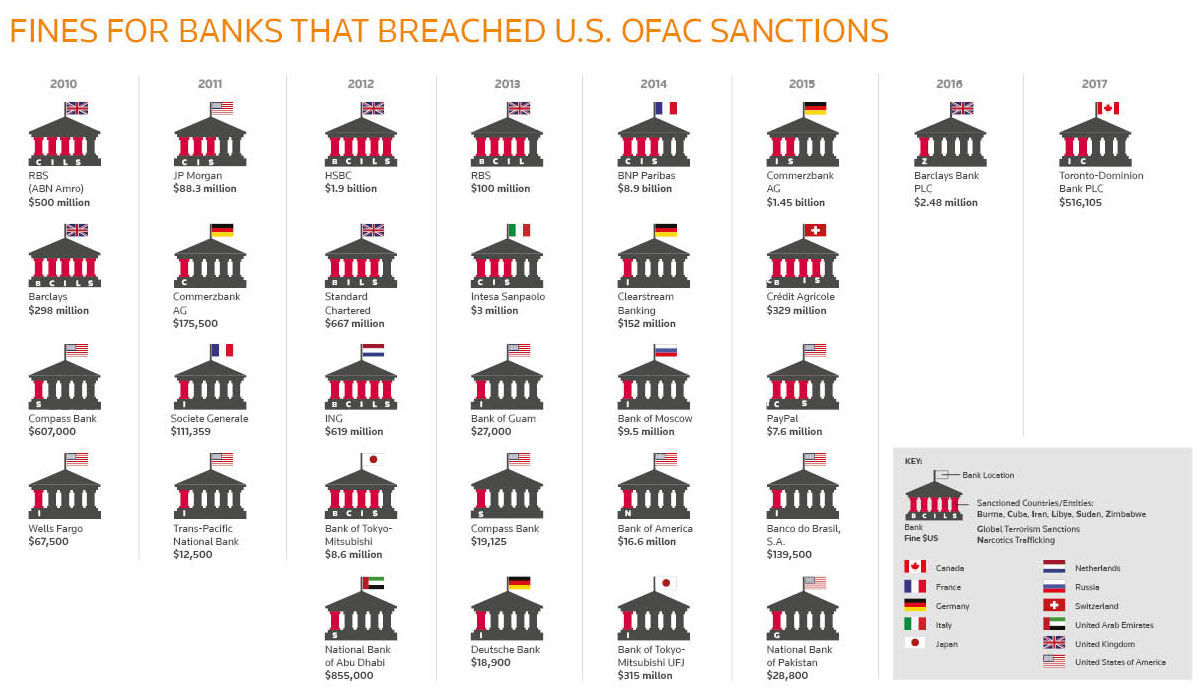

According to the Office of Foreign Assets Control (OFAC), the Russian government unfairly benefits from the political and business elite to promulgate “malign activity around the world”.

Seven oligarchs and 12 associated companies were added to the growing list initially instituted in 2014 after the Russian annexation of Crimea.

While the U.S. government action mandates the freezing of assets held by the sanctioned individuals and bars U.S. citizens from conducting business with them, it’s also a stark reminder of the challenges associated with conducting due diligence on individuals with the aim of identifying associated entities and business interests.

World-Check Sanctions — Addressing the 50 percent aggregate rule

Exposure to sanctions

The OFAC 50 percent rule states that any entity in which one or more sanctioned individuals own, either directly or indirectly, more than a 50 percent interest may also be sanctioned.

What regulators do not provide, at least in full, is a listing of all associated entities where the sanctioned individuals have significant holdings. The onus, therefore, often falls on organizations to fully understand their exposure to sanctions.

When organizations have on-boarded commercial clients or corporate third parties without fully understanding the Ultimate Beneficial Owners (UBOs) of these entities, they may be exposing themselves to sanctions violations.

Fully unwrapping corporate structures and identifying the UBOs will help organizations expose compliance risks buried within the ownership structure of a company.

Source of Wealth due diligence

The Panama Papers and other recent scandals have highlighted the challenges in unwrapping corporate entities in order to identify beneficial owners.

However, little attention has been given to the opposite due diligence process. When conducting due diligence on an individual, how do you go about identifying all the entities where he or she has a significant interest or influence?

Aside from sanctions compliance, the same challenge presents itself in financial services for wealth managers attempting to conduct Source of Wealth due diligence.

Assessments of an individual’s Source of Wealth are also relevant to organizations in gaming, investment migration, or any industry where deposits are taken from wealthier, and potentially, higher risk customers.

Additional screening

A proper Source of Wealth assessment aims to identify and describe all economic activities that contribute to an individual’s net worth; which may include employment, investments, and life events such as an inheritance.

The assessment goes beyond simply identifying the assets they own.

The aim here is two-fold; firstly to build a profile of an individual’s wealth to ensure it is proportionate to the products and services being offered, and secondly, to ensure there are no risks associated with the sources of wealth, including sanctions, money laundering or other illegal activity.

The sources of wealth themselves may prove to be high risk and may require additional screening.

For example, wealth derived from high risk industries in high risk jurisdictions may require additional scrutiny.

Wealth derived from inheritance may require an additional Source of Wealth assessment on the means by which the person who bequeathed the assets amassed the wealth originally.

Useful databases

Useful resources for understanding an individual’s network of corporate affiliations include cross-directorship databases (though these are not available in most jurisdictions), commercial company databases, media and Internet searches (results will vary on an individual’s public profile), and public records (corporate registry documents, annual reports, property records etc).

Conducting source of wealth assessments in emerging markets may require specialist skills as information is likely to be in local language and public records may be difficult to access and in some cases, in non-digital formats.