The social upheavals of 2020, from the uneven impact of the COVID-19 pandemic to calls for racial equality, increased the pressure on companies worldwide to make diversity and inclusion (D&I) practices a key area of their strategy. In South Africa, with its history of racial inequality, advancing black economic empowerment is an important national focus.

- Diversity and inclusion workplace practices allow companies to draw on a wide range of knowledge, experience and creativity.

- South African firms perform well on diversity and inclusion scores compared with global figures.

- Indices constructed on diversity and inclusion metrics can help investors place capital in a basket of companies that outperform.

For more data-driven insights in your Inbox, subscribe to the Refinitiv Perspectives weekly newsletter.

Following diversity and inclusion principles ensures that a company maintains a diverse workforce that reflects the community it serves and fosters an inclusive atmosphere where all employees feel welcome.

The result is that companies can draw on a wide range of knowledge, experience and creativity – and can attract the best talent.

In addition, many corporate customers are looking for sustainable products and organisations that demonstrate a commitment to society.

In a South African context, it is key that a commitment to society also incorporates an assessment of efforts by organisations to further enhance economic transformation and economic participation by previously disadvantaged people. This can be achieved through adherence with the government’s legislative framework that fosters diversity and inclusion initiatives.

Environmental, social and governance (ESG) metrics demonstrate that companies that support diversity and inclusion principles have a better chance of producing superior financial results – and rewarding investors.

How can you incorporate Refinitiv ESG data into your investment strategies?

Evidence from indices

Refinitiv, in collaboration with Satrix, a leading provider of index-tracking solutions in South Africa, launched the Refinitiv Satrix South Africa Inclusion and Diversity (Refinitiv Satrix I&D Index) in August; with Satrix launching an ETF off the back of the index shortly afterwards.

The index tracks the total return of select publicly traded equities with high diversity and inclusion scores on the Johannesburg Stock Exchange. In addition, the index benchmarks the key corporate Broad-Based Black Economic Empowerment (B-BBEE) programme scores.

If the Refinitiv Satrix I&D Index’s components are backdated for five years, its annualised return was 6.56 percent, outperforming the Refinitiv South Africa Total Return Index, which returned 4.65 percent during the same period.

In 2020, the Refinitiv Satrix I&D Index achieved a return of 3.46 percent, compared to -1.96 percent by the Refinitiv South Africa Total Return Index.

The historical data illustrate the promising prospects of investing in D&I in South Africa.

Performance and progress

In the Refinitiv ESG database, 105 South African companies have a D&I score and 122 have the four D&I pillar scores.

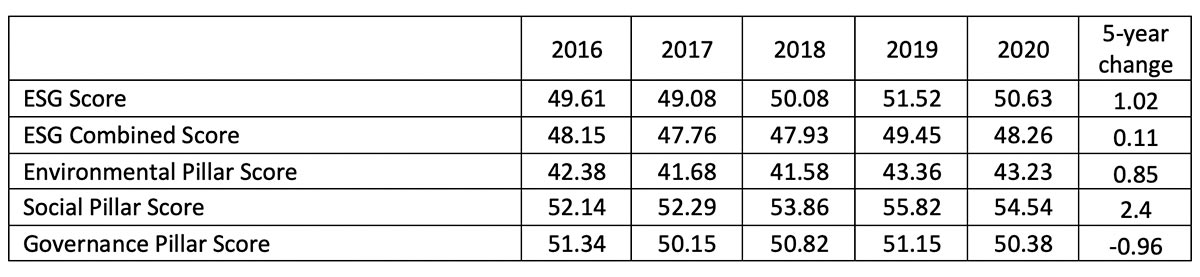

Performance/action by South African companies on ESG matters – backdated five years — appears to have stayed relatively flat.

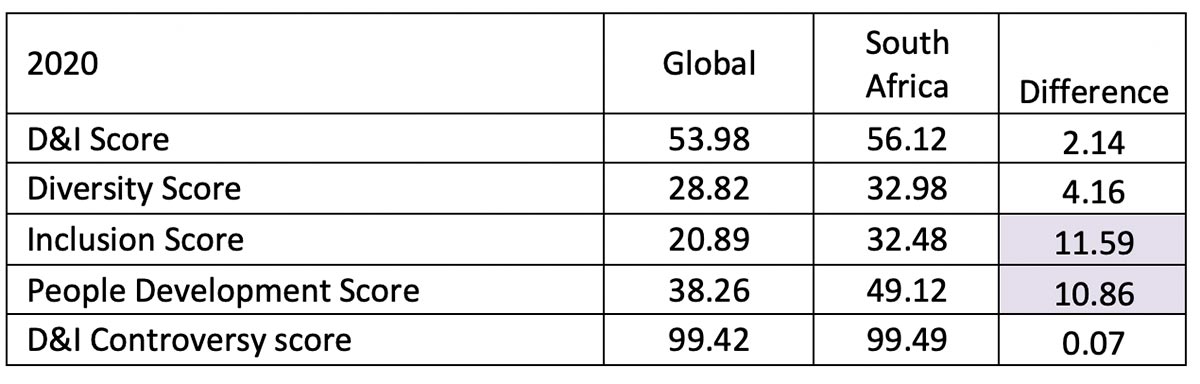

However, when looking at diversity and inclusion practices in South Africa compared with the world, South African firms perform better on all diversity and inclusion pillar scores in the Refinitiv ESG database, with inclusion and people development more than 10 percentage points stronger.

Finally, the importance of including diversity and inclusion metrics in investment strategies is illustrated by backdating the Refinitiv Satrix I&D Index for ten years, noting that it outperforms the broader market benchmark.

Investing based on diversity and inclusion metrics

Like the Refinitiv Satrix I&D Index, Refinitiv’s ESG metrics can be used to create a wide range of innovative investment vehicles allowing investors to commit capital to companies that actively invest and promote D&I values.

How can you incorporate Refinitiv ESG data into your investment strategies?