Momentum is building around factor investing, despite a shortage of programming and data science skills to meet this demand. Andrew Breton, Head of Quant Analytics and Research at Elsen, highlights an approach to quantitative investment strategies that doesn't require expensive Silicon Valley talent.

- Factor investing is growing in popularity, with half of the 300 institutional investors in an Invesco survey reporting they had tested or implemented factor investing strategies.

- Institutional investors often lack the programming or data science skills required to develop and implement factor investing strategies.

- QA Point powered by Elsen makes it quick and easy for anyone to work with massive amounts of data to develop quantitative strategies.

For decades, institutional investors have been refining their use of factor-based strategies. After Jack Bogle, the founder of Vanguard Group, introduced the concept of the index fund in 1975, investment professionals have sought new strategies to generate beta, and factors have risen to the top of the list.

The growing popularity of using factors as a means to generate better performance than index funds is well-understood anecdotally within the industry, and has recently started to be measured more systematically as well.

Late last year, Invesco released its third annual Global Factor Investing study, which starts to offer a benchmark on where the industry has been, and where it is headed when it comes to the perception and use of factors.

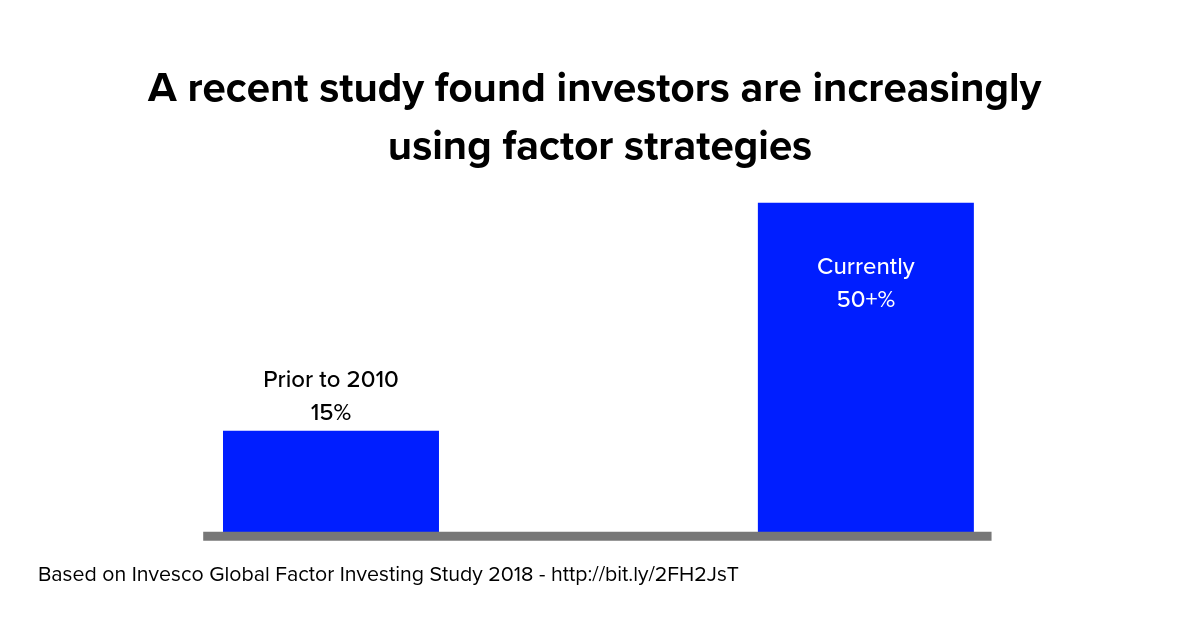

Based on a survey of more than 300 institutional and wholesale investors, Invesco estimates that about half of institutional investors have either tested or fully implemented factor-based strategies. And despite the long history of investors dabbling in factors, wider adoption is something that has just started to occur recently.

Only 15 percent of survey respondents said they used factor strategies prior to 2010, but usage has steadily climbed since then. Just over 30 percent started using factors between 2010 and 2014, bringing the industry to its current 50+ percent usage.

Peak popularity for factor investing

It’s clear that professionals from within the industry are relying on factors more often and will continue to do so. But is this trend resonating yet with the wider market, including the general public and retail investors?

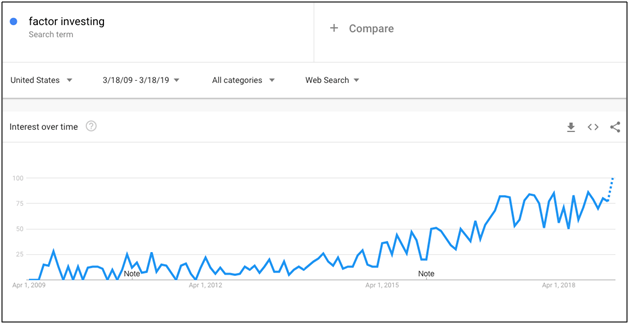

A quick look at Google Trends data says that it is.

Google Trends is a free tool that anyone can access in order to see the popularity of terms being typed into the world’s most popular search engine over time. It shows that over the past ten years, Google searches for “factor investing” have increased steadily.

Google Trends data shows the popularity of a term relative to the most popular point over a given period. In other words, a value of 100 is peak popularity for the term, and a value of 50 signifies a time when that term was half as popular compared with the peak.

As the chart above shows, Google searches for “factor investing” in the United States are hitting peak popularity right now and have been trending upwards for some time.

While this might be a quick and unscientific bellwether, the direction that it shows is clear and undeniable.

And remember, unlike the Invesco study which specifically targeted 300 professional investors, this data includes everyone that has used the Google search engine over the past ten years.

The bottom line is that this data suggests broad and increasing interest in factor-based investments.

Developing factor-based strategies

The challenge now for investment firms is meeting this growing demand amid a shortage of professionals that possess both the technical and financial knowledge it takes to develop and implement factor-based strategies.

This is no easy task at a time when nearly half of financial services leaders admit that finding necessary talent and skills is their number one concern.

There are many initiatives underway within the industry to close this gap. For example, firms are attacking the challenge from both directions, making an effort to educate investment professionals on computer programming and data science, and attempting to lure tech pros away from Silicon Valley and introduce them to finance.

But neither approach is sustainable over the long-term. Instead, technology needs to be developed in a way that is more intuitive and easy to use for any investment professional, regardless of their technical prowess. That’s exactly why Refinitiv and Elsen partnered to introduce QA Point Powered by Elsen.

A strategy that works

As a cloud-based application that can be accessed through any web browser, QA Point makes it quick and easy for anyone to work with massive amounts of data to develop quantitative strategies.

It doesn’t require any knowledge of R or Python – foreign programming languages to anyone outside of the computer science field, which have been traditionally used by quants.

Instead, with a few clicks of the mouse, anyone can use QA Point to access decades of financial data to perform backtests against any multi-factor strategies they wish to explore. This makes it quick and simple to develop and iterate on ideas, and find the strategy that works.

Demand for factor investing is sure to continue growing. Learn more about how QA Point – can empower any financial professional to thrive and find beta.